Ofi Invest Precious Metals

Make your portfolio glitter!

Precious metals – gold, silver, platinum and palladium – are now used in many industrial applications in the automotive, electronics, chemicals and jewellery and other sectors. Their applications include low-carbon-emission technologies. What’s more, against a backdrop of economic uncertainties and geopolitical tensions, “safe haven” assets such as gold are highly sought after to counter volatility on the financial markets. We therefore see precious metals as a source of investment opportunities.

What is a precious metal?

“Precious” metals are metallic chemical elements that are scarce and possess some monetary value.

They have practical applications everywhere in today’s economy.

investments,

technologies, etc.

“green” hydrogen,

jewellery, eyewear, etc.

Electronics,

jewellery, etc.

Electronics,

chemicals, etc.

Ofi Invest Precious Metals, an alternative for diversifying your portfolio

Simplified access

to the precious metals sector

A fund eligible for life insurance contracts

A fund denominated in euros

A fund hedged against currency risk

Daily liquidity

A diversifying portfolio

with a balanced fixed allocation

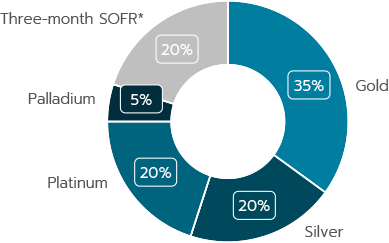

PORTFOLIO EXPOSURE TO PRECIOUS METALS

In order to maintain 100% exposure to precious metals, the sub-fund is exposed to 125% of the performance of the index.

* Secured Overnight Financing Rate: a benchmark rate established as an alternative to LIBOR, the London Interbank Offered Rate. LIBOR has been published in a number of currencies and underlies financial contracts worldwide.

Ofi Invest Precious Metals: a fund only loosely correlated to trends in other asset classes

HOW GOLD HAS TRADED DURING BEARISH US EQUITY MARKETS (BASED ON THE S&P 500)

Why choose Ofi Invest Precious Metals?

- Simplified access to the precious metals sector

- No investment in sector equities or bonds

- An investment eligible for life insurance contracts

- A management team recognised for more than 20 years on the metals and commodities markets

- A more than 10-year management track record

- Gold and other precious metals are historically resilient during periods of inflation and geopolitical uncertainty

- These assets are only loosely correlated to financial market trends

SILVER, A HIGHLY CHARGED METAL

Manufacturing alone accounts for a total of 49% of total silver demand(1), and demand could be boosted further by low-CO2-emission green technologies.

Production of photovoltaic panels, for example, accounts for 12% of global demand, a quantity that could quadruple over the next 10 years(2).

In the automotive industry, metal is used mainly in the electrical connections of vehicles’ electronic systems. Each electrical impulse in a modern car that starts the engine, opens the windows or adjusts the seats is activated by silver-based contacts.

Refer to the fund’s characteristics & documents for more details on its risks, fees and characteristics.

News related to the fund or its theme

A WORD ON - Understanding metals: silver, the jack-of-all-trades precious metal

20/05/2024