A WORD ON

SUSTAINABLE FINANCE

Preserving biodiversity: the emergency within the emergency

Equity fund manager

OFI INVEST ASSET MANAGEMENT

Biodiversity had long remained in the shadows of climate investment. But acting to preserve biodiversity has now become an emergency within an emergency.

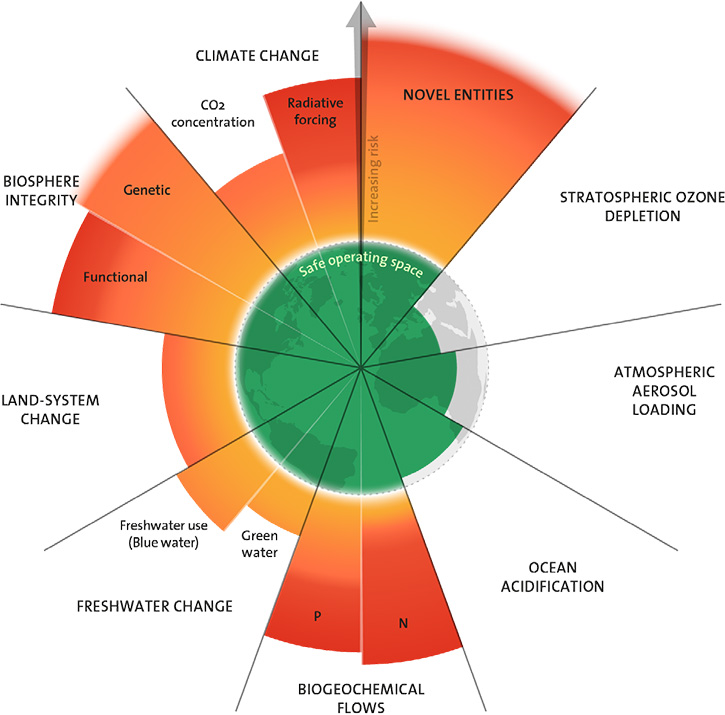

In 2009, a Stockholm-based research team quantified the risks arising from humanity’s impact on the planet and, more to the point, the nine broad processes involved in the functioning of ecosystem Earth – climate, biodiversity, the forests, changes in land use, the freshwater cycle, ocean acidification, disruption of biogeochemical cycles, aerosols emissions into the atmosphere, and shifts in the ozone layer. Each threshold crossed destabilises the planetary environment. So far, six thresholds have already been crossed, including depletion of biodiversity.

Finance is, in fact, on the front lines, as, according to the International Monetary Fund (IMF), almost half of global GDP derives directly from ecosystemic services that nature provides to humanity, whether for supply of resources or regulation of nature, including pollination and regulation of erosion. Preserving biodiversity is accordingly a vital necessity for safeguarding entire swaths of the economy, and the capital requirements for preserving and restoring it are considerable.

Yes, it is. The main challenge is in obtaining scientifically objective and reliable data. As a matter of fact, measuring biodiversity is far more complicated than measuring climate. For investors, proper measurements are necessary to ensure that well-founded decisions have been made. However, this lack of maturity should not hold investors back. On the contrary, better to invest now with the certainty that in the coming months and years, data will becoming increasingly available. With this in mind, the managers’ task consists in building a solid methodology.

We began with the five current drivers of depletion of biodiversity, as defined by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES): changes in use of land and sea, overexploitation of resources, climate change, pollution and invasive species. We evaluate the degree of pressure exerted by companies’ business activities (low, medium or high) and the remediation measures they are taking.

To do this, we have selected 70 indicators, in order to score each company’s practices. We assign a bonus to companies whose products and services offer solutions for preserving, and even restoring, biodiversity. Behind this methodology, we are driven by a firm conviction – that failing to manage biodiversity will ultimately undermine companies’ financial health.

Ultimately, targeted returns remains a decisive criterion. Investing in sustainable thematics must not mean giving up on financial performance.

To pick stocks, we focus on three research pillars: our in-house model of analysing negative impacts on biodiversity, our analysis of ESG (Environment, Social, Governance) criteria and our financial analysis of companies. And, lastly, we build into our investments a process of dialoguing and engaging with companies, in order to support them in taking biodiversity more into account in their activities.

Biodiversity is in a condition of serious risk.

When fewer than 10 out of 1 million species are lost, depletion of biodiversity is deemed to have no major impact on the biosphere. However, this threshold has been exceeded by far, as the number of species going extinct is now estimated to be 10 to 100 times Victoria RICHARD WEILL greater.

Completed on 29/04/2024

This promotional document was produced by Ofi Invest Asset Management, a portfolio management company (APE code: 6630Z) governed by French law and certified by the French Financial Markets Authority (AMF) under number GP 92-12 – FR 51384940342, a société anonyme à conseil d’administration [joint-stock company with a board of directors] with authorised capital of 71,957,490 euros, whose registered office is located at 22, rue Vernier 75017 Paris, France, and which has been entered into the Paris Registry of Trade and Companies under number RCS 384 940 342. This promotional document contains informational items and figures that Ofi Invest Asset Management regards as well-founded or accurate on the day on which they were researched. No guarantee is offered regarding information or figures from public sources. The analyses presented herein are based on the assumptions and expectations of Ofi Invest Asset Management at the time this document was written. It is possible that some or all of these assumptions and expectations may not be borne out in market performances. They do not constitute a commitment to performance and are subject to change. This promotional document offers no assurance as to the suitability of products or services presented and managed by Ofi Invest Asset Management regarding the financial situation, the investor’s risk profile, experience or objectives and constitutes neither a recommendation, nor advice, nor an offer to buy the financial products mentioned. Ofi Invest Asset Management declines any liability for any damages or losses resulting from the use of all or part of the information contained herein. Before investing in a fund, all investors are strongly urged to review their personal situation and the benefits and risks of investing in order to determine the amount that is reasonable to invest, but without basing themselves exclusively on the information provided in this promotional document. An investment’s market value may fluctuate either upward or downward and may vary with changes in interest rates. No guarantee is offered that the products and services presented herein will achieve their investment objectives, which depend on market risks and the state of the economy. Past performances are not a reliable indicator of future performances. The Key Investor Information Document (KIID) and the prospectus are offered to subscribers prior to investing and must be given to them upon subscription. The KIID, prospectus and latest financial statements are available to the public upon request from Ofi Invest Asset Management. FA24/0123/18042025