A WORD ON

COMMODITIES

Silver: the jack-of-all-trades precious metal

Head of Commodities

OFI INVEST ASSET MANAGEMENT

Commodities Fund Manager

OFI INVEST ASSET MANAGEMENT

Also like gold, silver has also been appreciated for centuries as an investment and as a store of value and used as a means of exchange. However, its lower value and greater availability makes silver accessible to more people who prefer physical silver to paper money.

Thanks to its exceptional properties, silver is also an industrial metal. It is, in fact, the world’s best conductor of electricity. But did you know that it is also a choice material used in pharmaceuticals and in developing nanoparticles? Or that it is essential to the energy transition and in the coming years will play a major role in the booming applications of artificial intelligence?

These new uses have caused profound shifts in the balance of the silver market. Here is an update on this complex and fascinating market.

SILVER’S MANY FACETS

Every material is unique. However, silver’s wide diversity of properties and applications make it a truly exceptional metal.

Silver is first of all regarded as a precious metal: it is ductile, hence easily stretched without being broken, and malleable, and can be hammered out easily. It is also one of the most brilliant and reflective metals. These properties make it a choice metal for the jewellery sector, which accounted for 18.8% of silver demand(1) in 2022.

But silver is also an industrial metal and one of the world’s best conductors of electricity. It is used in circuits, cables and electrical switches, and its unique properties make substitution difficult. Its great malleability make it essential to the smallest electronic components, such as those found in smartphones. Most computers, cell phones and automobiles also contain silver. Silver is also the ideal substance for coating electrical contacts, such as printed circuits, thanks to its high electrical conductivity and durability. Painting silver ink on any non-metallic surface makes it an electrical conductor, eliminating the need for wires. Paper-thin antenna of electronic chips consist of silver powder.

Less known is silver’s use in pharmaceuticals and biotechnologies, even though these applications are widespread. For silver has the unique property of being able to penetrate bacterial cells – without damaging healthy cells – and to destroy a microbe’s ability to reproduce. Silver ions can thus be used as a biocide. This is increasingly important as overuse of chemical antibiotics is creating numerous bacterial resistances.

In addition to silver’s many historical applications, new uses are causing profound shifts in market equilibria and are triggering a spike in silver demand.

CONSTRAINED PRODUCTION

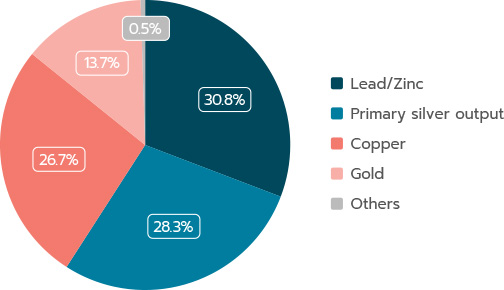

Silver is sometimes found in the earth’s crust in its purest form, but it is more commonly extracted from mines that extract other metals, such as gold, copper or lead, from which it must be separated. More than 70% of extracted silver comes from mines exploiting other metals, of which silver is a co-product.

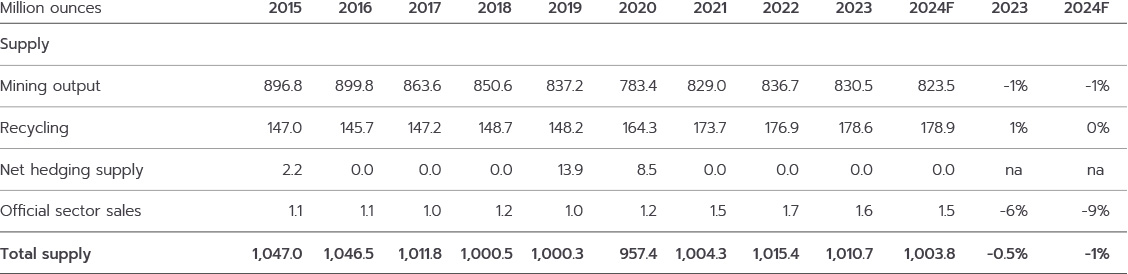

In 2023, global silver supply came to 29,000 tonnes, of which 23,800 tonnes in primary output, or extracted silver, plus a little more than 5,000 tonnes recycled during the year.

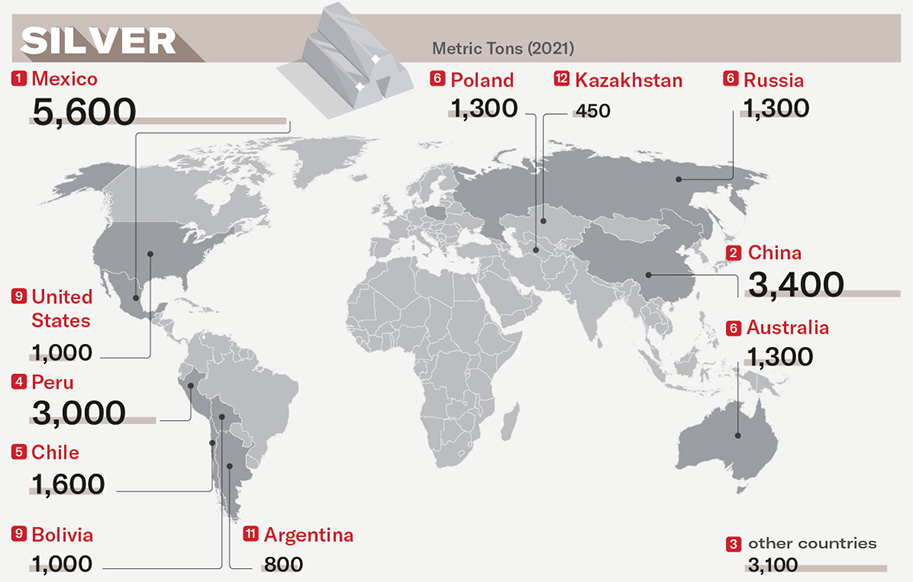

In terms of geographical breakdown, the main silver producer is Mexico, with about 23.5% of global primary output in 2023, followed by China and Peru, each with between 12% and 14% of output. Otherwise, production is rather far-flung.

For a complete picture, keep in mind that silver reserves in primary active and planned mines now total about 3,466 million ounces (107,812 tonnes)(2), or four years of output based on current production levels. This is down by about 5% compared to 2022, due to natural depletion, as well as tougher economic conditions requiring the conversion of resources into reserves. More generally, global identified reserves of all sources of silver amount to 530,000 tonnes, or just 20 years of output.

Like many other metals, and even as demand is rising fast, silver production is facing serious difficulties, including social unrest, strikes, and discontent with local governments that have brought mining to a standstill (one of these is the closing of the Cobre-Panama copper mine – with silver as a co-product – for an indefinite period, announced in late 2023), steep rises in operating and financing costs, production declines due to thinner ore concentrations at certain mines… all these factors led to a 1% decline in primary silver output in 2023.

For 2024, primary silver output is expected to decline by another 1%. But it could be worse. With more and more constraints on mining, companies’ announced output targets are justifiably raising more and more doubts.

We might add that this shortfall in production is nothing new. Yields have been falling for more than 10 years, with falling mining yields (the ore concentration in the ground) being one of the main causes.

Also keep in mind that all these difficulties – combined with extra-financial pressure on mining companies and current silver market prices, which are not high enough to encourage new projects – are discouraging investments in the sector. This rules out any possibility of a significant increase in supply in coming years, especially as it now takes an average of 17 years to open a new mine(3).

This annual supply trend compares to global demand of 33,000 tonnes in 2023. The market thus faced a significant supply-side deficit equivalent to almost 15% of global demand – for the third consecutive year.

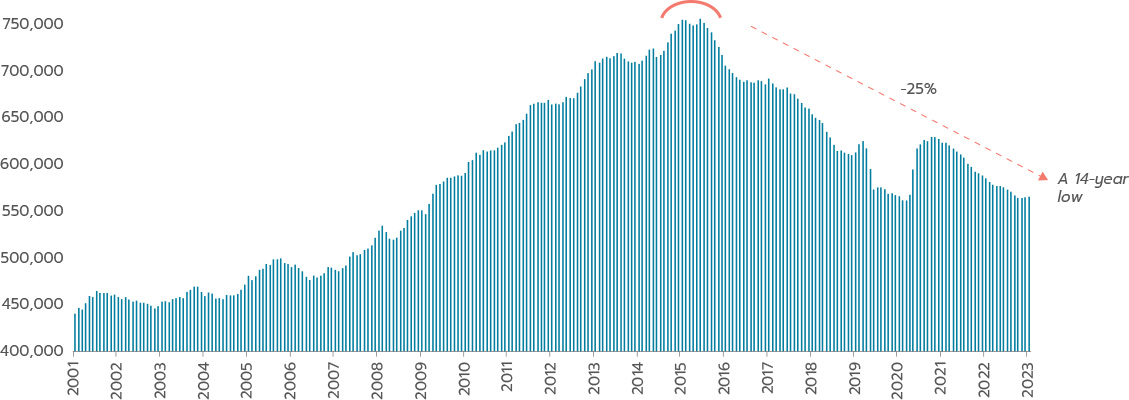

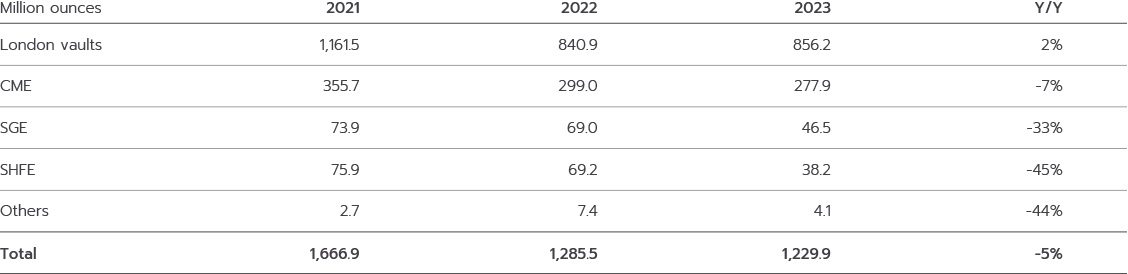

One reason the market has been able to absorb this deficit without triggering a spike in prices is its significant silver inventories. Some of these inventories have been tapped to help meet this surplus demand. As of the end of 2023, official known inventories amounted to 1229.9 million ounces, or 38,036 tonnes of silver. However, recent trends in these inventories provide an accurate reflection of the wide deficits on this market. Since 2021, they have declined by 26%. The steepest decline in inventories was in China, with the combined inventories of the Shanghai Gold Exchange (SGE) and the Shanghai Futures Exchange (SHFE) shrinking by 39% just in 2023 and continuing to fall in early 2024. This is due to the phenomenal boom in demand for silver for the local photovoltaic industry. We’ll have more on that later.

Metals Focus, LBMA, CME, SGE, SHFE, MCX & OSE

WHAT ABOUT THE TRANSITION IN ALL THIS?

In addition to this state of affairs in the broad equilibria between silver supply and consumption, many factors are now causing in-depth changes to market conditions. These include new uses that have emerged in recent years, which are already forming a major and still-growing portion of demand.

The first of these is the use of silver in the photovoltaic sector, a booming market that accounts for one of the major sources of decarbonated electricity generation. Silver powder, processed into a paste, is applied on silicon wafers to make a solar panel. When sunlight hits the panel, electrons are released, and silver conducts electricity for immediate use or to be stored. Silver demand from this industry is rising sharply, from less than 5% in 2014, it exceeded 15% of global demand in 2023, and is expected to approach 20% of demand in 2024.

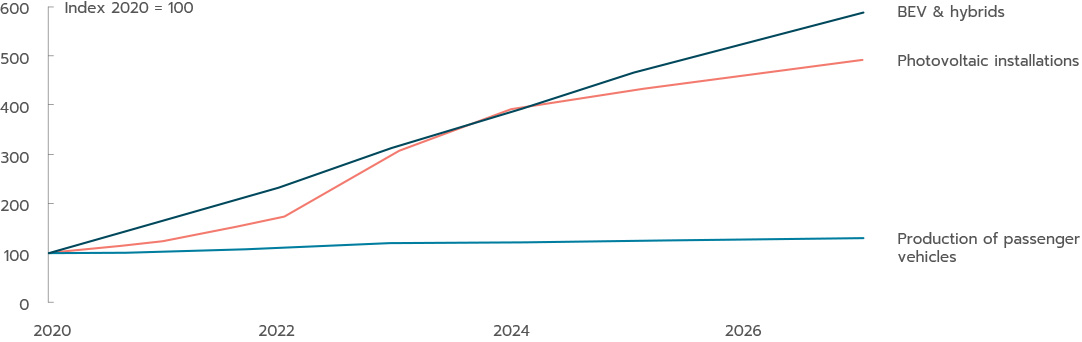

GTM, Metals Focus, LMC Automotive, A GlobalData Company

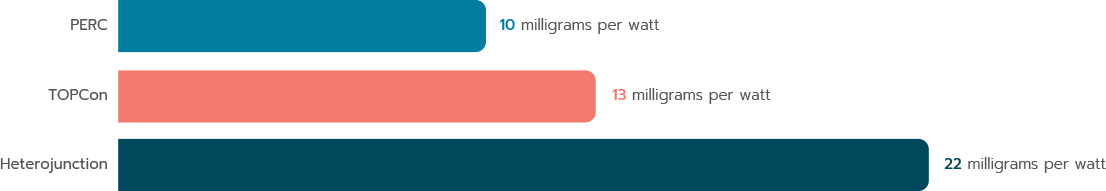

This trend is likely to accelerate. The solar panel technology that is currently dominant – the passivated emitter and rear contact (PERC) cell – is being supplanted by two, more efficient technologies. “Tunnel oxide passivated contact (TOPCon) solar cells consume 13 milligrams of silver per watt, and heterojunction cells, 22 milligrams, while current PERC cells require just 10 milligrams. Silver needs will accordingly rise significantly in this industry, with the two new technologies expected to dominate the market in the next two years.

We might add that some manufacturers are trying to find silver substitutes in the form of other metals, such as copper, for the making of solar panels. They are currently facing two main obstacles: 1/ the performances of the resulting panels are far below those of silver-containing panels; and 2/ copper is also seeing far greater demand, due to the electrification and digitalisation of the economy, as well as production constraints. These two factors are limiting the possibilities for large-scale substitution.

Apart from photovoltaic, another market is emerging for silver, of a significant size and destined for strong growth: electric vehicles. The presence of silver in batteries is nothing new. Its properties are so rich that it is found in most modern battery categories, from flashlights to the batteries of the Apollo lunar module of the 1960s!

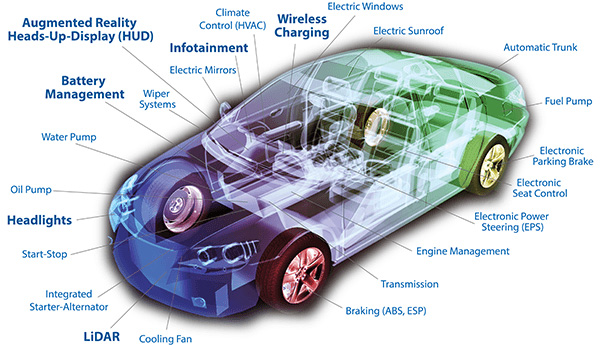

But the boom in electric batteries in the transport sector is now causing a significant increase in silver demand. An electric vehicle contains 25 to 50 grammes of silver, vs. 18 to 34 grammes in an ICE vehicle. Silver has many applications in an electric vehicle. In the form of silver paste between battery cells, it is used to conduct electricity. It is also used in welds, circuit-breakers, electricity conducting components at charging stations, etc.

These various uses make silver a must, regardless of trends in the various battery chemistries: nickel, manganese, cobalt, lithium, iron, phosphate, etc., which make up the insides of an electrical battery.

Through the boom of these two new sectors of photovoltaic energy and electrification of transports, the energy transition constitutes a major source of demand for silver. One sign of this: in 2023 silver consumption from these two new markets already accounted for 26% of global demand, up from zero 20 years ago. The portion of silver output consumed by the photovoltaic energy sector is indeed growing at a breakneck pace. From 19% of global supply in 2023, it is likely to capture more than 23% in 2024. Along with demand from the EV industry, these new uses are expected to account for almost 40% of global supply this year. And growth in these two segments is just beginning. In the solar sector alone, we will have to double the record annual installations of capacities of 2023 to manage to contain global warming – all by 2030!(4)

A greater and greater portion of silver output will therefore inevitable be absorbed by these sectors.

And lastly, there is an obvious link between the development of the artificial intelligence (AI) sector and the metals market. Many activities will be affected by the development of AI and will, in turn, be new sources of demand for electrical-conducting materials. To cite one example, the transports sectors will see strong growth in demand for sensors and cameras for autonomous vehicles. These will consume far greater amounts of silver, particularly in semiconductors, controls, fuses, switches, control units, infrared radars, LIDARs and movement sensors.

In addition to the end uses that will require more silver, the AI-driven increase in energy demand also means increased consumption of silver. For AI hosting centres will require huge quantities of energy to execute algorithms. The International Energy Agency (IEA) recently forecast that total datacentre electricity consumption could double by 2026, reaching the equivalent of Japan’s consumption of electricity. Existing electrical grids will have to be expanded to accommodate these additional capacities. Accordingly, silver demand will ride growth in the demand for components used in energy distribution and transmission systems, such as electrical contacts in switches, transformers, relays and condensers. This new demand for energy is also likely to boost solar power, a big consumer of silver.

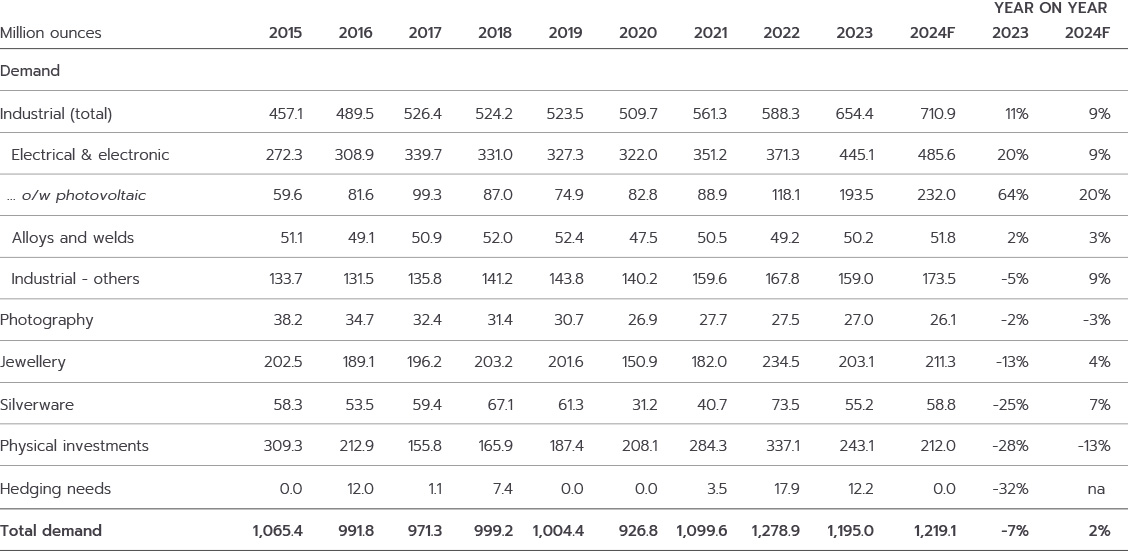

For 2024, global demand for silver is expected to rise by about 2%, driven by a stabilisation in jewellery and investment uses but mainly by a steep rise in industrial demand (+ 9%), itself driven by the photovoltaic boom. 2024 is therefore expected to be the market’s fourth consecutive year in deficit.

As mentioned above, silver output is globally inelastic and even heavy investments in exploration and extraction would not be enough to boost supply in the short term, given the long lead times needed to open new mines. That’s why we think that we are now entering into an era of structural deficits between silver supply and demand, something that could end up creating strong tension on the physical market and, hence, on prices.

Silver inventories will be of some help in absorbing these recurring deficits, but those inventories are not inexhaustible and will be gradually used up over time. Especially as not all of them can be made available and used. Some of them are strategic sovereign inventories or serve as collateral on silver derivatives markets.

Silver’s surprising properties make it a versatile metal that is essential to many industrial sectors. Most of our electronic devices, from the simplest to the most elaborate, contain silver. If your device has an on/off button – whether a computer, a remote control or a child’s toy – there is probably silver in it.

The silver market is experiencing a transformation that is both rapid and radical: new uses, particularly in the energy transition and digitalisation, have quickly taken over a large portion of global output. Within a few years, booming demand has been such that it already accounts for one third of silver demand!

All of this has exerted pressure on silver supply so great that a study from the University of New South Wales suggests that the solar power sector alone could exhaust 85% to 98% of global silver reserves by 2050(5). Barring a rapid increase in output, which is hard to imagine as things now stand, the market will have to settle for the conventional adjustment variable on an unbalanced commodities market: price.

Completed on 20/05/2024

(1) Source: Silver Institute

(2) Source: The Silver Institute, World Silver Survey March 2024

(3) Source: International Energy Agency (IEA)

(4) Source: International Energy Agency (IEA), Net Zero by 2050, “SDS” scenario of capping global warming at 2 degrees by 2100

(5) https://www.mining.com/web/the-worlds-appetite-for-solar-panels-is-squeezing-silver-supply/

This promotional document was produced by Ofi Invest Asset Management, a portfolio management company (APE code: 6630Z) governed by French law and certified by the French Financial Markets Authority (AMF) under number GP 92012 – FR 51384940342, a société anonyme à conseil d’administration [joint-stock company with a board of directors] with authorised capital of 71,957,490 euros, whose registered office is located at 22, rue Vernier 75017 Paris, France, and which has been entered into the Paris Registry of Trade and Companies under number RCS 384 940 342. This promotional document contains informational items and figures that Ofi Invest Asset Management regards as well-founded or accurate on the day on which they were researched. No guarantee is offered regarding the accuracy of information or figures from public sources. The value of an investment on the markets may fluctuate either upward or downward and may vary because of shifts in exchange rates. Depending on the economic situation and market risks, no guarantee can be provided that the products or services presented herein will achieve their investment objectives. Past performances are not a reliable indicator of future performances. The analyses presented herein are based on the assumptions and expectations of Ofi Invest Asset Management at the time this document was written. It is possible that some or all of these assumptions and expectations may not be borne out in market performances. They do not constitute a commitment to performance and are subject to change. This promotional document offers no assurance as to the suitability of products or services presented and managed by Ofi Invest Asset Management regarding the financial situation, the investor’s risk profile, experience or objectives and constitutes neither a recommendation, nor advice, nor an offer to buy the financial products mentioned. Ofi Invest Asset Management declines any liability for any damages or losses resulting from the use of all or part of the information contained herein. Before investing in a fund, all investors are strongly urged to review their personal situation and the benefits and risks of investing in order to determine the amount that is reasonable to invest, but without basing themselves exclusively on the information provided in this promotional document. Cover photo: Shutterstock.com. FA24/0143/14052025.