A WORD ON

EQUITIES MANAGEMENT

Understanding the "Magnificent Seven"

US equities fund manager

OFI INVEST ASSET MANAGEMENT

The expression “Magnificent Seven” took over from “GAFAM” (Google, Apple, Facebook, Amazon and Microsoft) in early 2023. It refers to seven US companies, which are leaders in their respective fields and have achieved outstanding market performances. In alphabetical order, they are: Alphabet (Google’s parent-company), Amazon, Apple, Meta (formerly Facebook), Microsoft, Nvidia and Tesla.

The term refers to the film "The Seven Samurai" of the Japanese director Akira Kurosawa, in which seven samurais defend villagers under attack by bandits. "The Seven Samurai" was remade in the US in the 1960s under the title "The Magnificent Seven".

Extrapolated on the equity markets, the “Magnificent Seven” are seven specialists is their respective fields, able to overcome obstacles and who assert themselves aggressively: Apple in consumer devices and services, Microsoft in software and the cloud, Alphabet in online search and advertising, Amazon in e-commerce and cloud computing, Meta in social media, Nvidia in semiconductors and AI, and Tesla in electric vehicles. Together, they form a sort of interconnected technological ecosystem symbolising innovation and growth.

In late May, the “Magnificent Seven” exceeded 14,000 billion dollars in market capitalisation and accounted for more than 30% of the S&P 500 and more than 40% of the tech-heavy Nasdaq 100. This concentration nudged the S&P 500 into slightly positive territory for 2023(1) even though most other companies in the index finished the year in the red. From a glasshalf- full perspective, it also masked the rather disappointing showings by other S&P 500 companies and provided a skewed image of the general state of health of the US equity markets.

Critics also point the finger at excessive market concentration and the indices’ dependence on a few tech giants, thus raising questions of market diversity and stability.

| Capitalization in billions USD at the close of 05/30/24 | S&P&500 | NASDAQ 100 | MSCI WORLD | |

|---|---|---|---|---|

| MICROSOFT | 3,082 | 6,99% | 8,66% | 4,55% |

| APPLE | 2,933 | 6,29% | 7,95% | 4,36% |

| NVIDIA | 2,718 | 6,19% | 7,11% | 4,24% |

| ALPHABET | 2,136 | 4,24% | 5,55% | 2,97% |

| AMAZON | 1,866 | 3,72% | 5,13% | 2,59% |

| META | 1,185 | 2,33% | 4,55% | 1,61% |

| TESLA | 570 | 1,12% | 2,31% | 0,79% |

| Total weight "Magnificent 7" | 30,88% | 41,26% | 21,11% |

After the 2008-2009 financial crisis, interest rates were very low for a very long time. Then Covid-19 happened, disrupting global supply chains and the operations of large companies. In reaction to the steep inflation that followed, the US Federal Reserve quickly raised its key rates. This had a big impact on companies and the financial markets, as phases of steeply rising rates hit small caps and leveraged and/or non-profitable companies the most. Conversely, fast-growing large caps, such as the “Magnificent Seven”, are more resilient and serve investors as “safe havens”, just like the mercenaries in The Seven Samurai, who offer protection to the villagers.

These companies invest massively in research and development, enjoy high barriers to entry, and have a very broad installed base of users, like Microsoft and Apple with their products and services, or Google, on whose search engine more than 90% of online searches are made worldwide. This generates recurring revenues and high margins.

Most of these companies enjoy “easement” fees with their services, like Apple, which grabs as much as 30% of the revenues of app developers at the App Store and each year receives a large sum from Google to be the default search engine in Safari (20 billion dollars paid out in 2022, or 2 billion more than in 2021). Also under the category of “easements”, advertisers who want the biggest and best-targeted audiences in digital media have no choice but to go through either Google or Meta. Much of Google’s and Meta’s profitability is from advertiser fees.

Microsoft offers personal AI assistants, such as Copilot, at 30 dollars per user per month, while Tesla sells its FSD driving software at 99 dollars per month. If all Tesla drivers were to use this software, that would generate considerable revenue.

Absolutely. These companies are, in our view, at the heart of major societal changes, which may justify their presence in various thematic funds. For example, companies such as Google and Meta have become essential players in sharing information and knowledge via social media and search engines, while Tesla is a key player in the transition to electric vehicles and autonomous driving, and Microsoft and Nvidia are bets on the use of artificial intelligence.

Each of these companies is unique, but, given their major impact on transforming our societies, we sometimes find them grouped together by investors under various investment thematics, such as big brands, the transition or the demographic revolution.

Of course, managers must be selective and keep a critical mind in weighting each one of them.

We expect the “Magnificent Seven” to remain benchmark stocks, given their dominance and innovativeness. However, investors must be aware of the potential risks that their heavy weighting in the indices could engender. For example, excessive investment without a sufficient return on investment could affect their market performances. There is also the risk of regulation by antitrust and competition authorities, who are keeping a close eye on these companies, some of which are close to having a dominant position on their respective markets. And, of course, they are not infallible!

In 2022, some of them went through tough times, including Meta, which was punished on the markets for its massive investments in the metaverse, the return on investment of which had been cast into doubt. This sanction pushed Meta to tweak its strategy by cutting spending, which boosted its results considerably and triggered a rally in its shares.

Current valuations of the “Magnificent Seven” are justified by very high growth expectations, which may not last forever.

Investors must not ignore the challenges that these companies will be facing in the future. Tesla, for example, will be facing keener competition in electric cars from Chinese automakers, and Nvidia’s dominance in artificial intelligence could come under attack.

Ultimately, the “Magnificent Seven” are a motley crew. In 2023, they all achieved market gains and single-handedly carried the indices, but that doesn’t mean they will continue to do so. For example, Tesla and Apple were both punished recently, while Nvidia continues to set record after record.

The history of the financial markets shows that even the largest companies can be supplanted or have their influence decline over time. Rapid technological changes, new regulations and market disruptions are all factors that could change membership in the “Magnificent Seven” or give rise to a new concept...

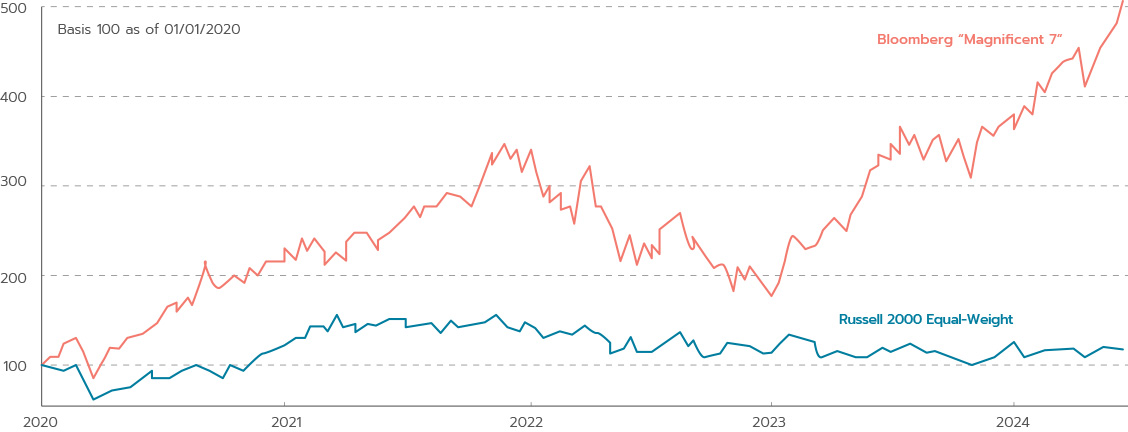

Since the start of 2020, the “Magnificent Seven” have gained 400%, vs. just 17%(2) by the Russell small cap index.

Completed on 17 June 2024

This promotional document was produced by Ofi Invest Asset Management, a portfolio management company (APE code: 6630Z) governed by French law and certified by the French Financial Markets Authority (AMF) under number GP 92012 – FR 51384940342, a société anonyme à conseil d’administration [joint-stock company with a board of directors] with authorised capital of 71,957,490 euros, whose registered office is located at 22, rue Vernier 75017 Paris, France, and which has been entered into the Paris Registry of Trade and Companies under number RCS 384 940 342. This promotional document contains informational items and figures that Ofi Invest Asset Management regards as well-founded or accurate on the day on which they were researched. No guarantee is offered regarding information or figures from public sources. The analyses presented herein are based on the assumptions and expectations of Ofi Invest Asset Management at the time this document was written. It is possible that some or all of these assumptions and expectations may not be borne out in market performances. They do not constitute a commitment to performance and are subject to change. FA24/0168/12122025