PERSPECTIVES

MARKET AND ALLOCATION

Our experts monthly overview

OUR CENTRAL SCENARIO

Deputy Chief Executive Officer,

Chief Investment Officer

OFI INVEST

More of the same?

Once again in 2024, the year began with the US economy surprisingly resilient and the euro zone side-stepping a recession. Inflation, meanwhile, continued to recede, albeit at a slower pace. The “Goldilocks” scenario still seems to be on track.

Central bankers took note of the need to ease monetary policy in 2024, as the pace of inflation slowed. Nevertheless, they are in no hurry to modify either the timing or extent of their key rate cuts. Jerome Powell went so far as to thwart market anticipations in ruling out any rate cut for March. We are therefore leaving unchanged our scenario of initial rate cuts in late spring and three or four 0.25% reductions for the full year.

As we expected last month, a pullback in long-term rates sent them back to levels that we believe are close to neutrality for the next few months on both sides of the Atlantic. Government bonds are expected to perform close to carry rates over the full year, albeit with volatility stoked by uncertainties over trajectories of macroeconomic figures, volatility that will present opportunities.

Corporate bonds continue to offer an attractive risk-return over time. However, some recent idiosyncratic risks remind us of the need for selectivity, as the effects of past monetary tightening are still being felt.

After riding the fall in bond yields late last year to a strong performance, equity markets did not give up their gains when bond yields rebounded, and end January in positive territory. However, a two-track market has taken shape, as the “Magnificent 7” (buoyed by strong earnings), artificial intelligence thematics, and the return of luxury sector have left other sectors and other market caps in their dust. On this two-track market – where the expected economic slowdown and the lack of geopolitical premium is being offset by a thematic, a sector, or an overbought “Goldilocks” scenario (the positive scenario), we are sticking to our neutral stance, pending a phase of volatility for opportunities to take on more bullish exposure.

OUR VIEWS AS OF 06/02/2024

We reiterate our neutral position on government bonds. 2.30%/2.40% is a likely trading range for the Bund over the next few months, around which we can retake tactical positions. In a more favourable macroeconomic environment, our preference is therefore for higher-yielding assets, such as investment grade or high yield corporate bonds. Returns in absolute terms, however, are lower than they were last quarter and call for greater caution in the short term. Selectivity and diversification will therefore be a must in the coming months. With yields of close to 4%, money-market funds are still especially attractive. This market configuration is likely to last until the initial central bank rate cuts.

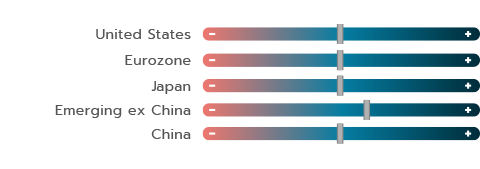

Geographically, we make no distinction between the United States and Europe. On the one hand, the US market’s valuation is 50% greater than Europe’s, which would call for underweighting it but, on the other hand, Wall Street does have a reservoir of high-growth tech stocks that makes the rest of the world green with envy. Note, however, that the S&P 500 depends on about a dozen, heavily weighted stocks. As for China, we have decided to raise our stance by one notch. No, fundamentals have not suddenly improved, but the disastrous showing as the year began (with the local index down by more than 15% and the Hang Seng in Hong Kong down by almost 10%) could bring in some bargain hunters.

A series of strong economic numbers in the United States triggered a dollar rally in January. We don’t expect it to continue, assuming disinflation stays on track in the US and economic activity rebounds in the euro zone. We remain constructive on the yen, based on the assumption that monetary policy should continue to normalise in Japan, given the good level of domestic inflation at this stage.

MACROECONOMIC VIEW

LOOKING FOR LANDING

Head of Macroeconomic Research

and Strategy

OFI INVEST ASSET MANAGEMENT

US economic growth ended 2023 on a tear. Household consumption hardly slowed at all in the fourth quarter, and the savings rate fell to 3.7% in December, far below its 8.5% historical average. One more factor in the US’s resilience: other domestic demand components, such as investment, remain strong, despite high interest rates. The strength of US consumption is being driven by two main factors: excess demand on the job market (with still 1.5 job openings for each unemployed person) and ongoing disinflation. Available research shows that the richest Americans can still count on surplus “Covid” savings, which they are probably using now, while the less wealthy buy more on credit. Credit cards and “buy now pay later” payment options became popular in the US in 2023. These options encourage consumers to spend as much as 20% more than they would otherwise, according to a New York Federal Reserve study.

ROBUST CONSUMPTION CONTINUES TO SUPPORT THE US ECONOMY

Other indicators also suggest that growth could surprise on the upside.

These include manufacturing surveys, which reflect initial signs of acceleration in international trade and, hence, in new foreign orders, and bank credit conditions, which have improved over the past two quarters. We have accordingly raised our 2024 US growth to 1.6%, thanks to stronger carried over growth. We could be raising this forecast further, given the pace of the economy in early 2024.

Regarding US inflation, the consumer price index rose by 3.4% year-on-year in December, but the pace was slower in the personal consumption expenditures deflator, the US Federal Reserve’s favourite yardstick, which was stable at 2.6% year-on-year. The Fed’s cautious stance is due to stubborn inflation in services and a weakerthan- expected cooling off of the housing sector. The Fed is waiting for confidence to improve before easing monetary policy. In our view, if disinflation stays on track in the coming months, an initial rate cut around summer looks like the most likely scenario.

AN INITIAL ECB RATE CUT EXPECTED THIS SUMMER

In the euro zone, data from national accounts show that activity once again stagnated this winter, with zero GDP growth in the fourth quarter. Germany is in recession, while France, Italy and Spain managed to avoid that. The scenario of a gradual recovery remains the most likely. It is being supported by signs of improvement in PMI manufacturing surveys and by demand for credit, which recovered slightly in in the past two months, as banks tightened credit conditions less.

INFLATION CONTINUES TO RECEDE IN THE EURO ZONE

Inflation once again receded in January, from 2.9% to 2.8% in the euro zone. Core inflation also did, by one tenth of a percentage point, from 3.4% to 3.3%. The sector breakdown shows that disinflation continues in manufactured goods and food, and we expect it to continue doing so in the coming months. However, services inflation has stabilised at a relatively high level of 4%. The risks of higher maritime freight costs in the Red Sea are worth keeping an eye on(1). Based on our reading of the situation, if the January cost shock persists, inflation of industrial goods in the euro zone could rise moderately in the coming quarters, albeit with an modest overall estimated impact on inflation, of no more than 0.15 percentage point this year. Moreover, current fears seem to be driven by an overdone comparison with Covid.

Covid was an unprecedented supplyside shock (with restrictions, factory closings, etc.) and, at the same time, a demand-side shock (with heavy demand for goods driven by the restrictions, substantial fiscal support, etc.).

On the monetary policy front, the ECB seems to be keeping all its options on the table for its upcoming meetings, given the wide divergences of opinions in Governing Council member statements. As a result, if inflation surprises on the downside, an initial rate cut in April cannot be ruled out. But on the whole, and in accordance with our baseline scenario, there is no economic urgency that would justify a rate cut before summer.

INTEREST RATES

IS THE PERFECT MARKET SCENARIO COMING TO PASS?

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

After their steep pullback in December, long-term yields naturally rebounded in January. After falling below 2% in December, the 10-year Bund yield moved back up to around 2.20% in late January. This correction was driven by at least three factors:

- The first of these is technical, with the return of primary issuance. As is often the case, issuers returned massively to the market for refinancing in January after sitting out December. Encouraged by heavy demand, treasurers issued on long maturities, causing a slight steepening in yield curves.

- The second factor is macroeconomic. With the euro zone having barely avoided a recession with growth of 0.5% in 2023, leading indicators seem to point to a slight recovery in 2024. Actual inflation was also a factor in support, with the convergence towards the 2% target, that is well under way in Europe, as well as in the US. The scenario is even brighter in the US, with 2023 growth of 2.5% and an outlook for 2024 that could also be revised upward. Robust US growth confirms the soft landing scenario and, for the most optimistic, a no-landing scenario!

THE MARKETS RATE CUT EXPECTATIONS LOOK OVERDONE

- The third factor is the language of central bankers in reaction to economic forecasts. We’re thinking of the shifts in tone late last year Jerome Powell and Christine Lagarde, confirming that key rates would fall in 2024. The markets got so carried away that they began pricing in rate cuts as early as March or April, and a total of five or six 25 basis point cuts on the year. We thought this was overdone and even today the beginning of the adjustment cycle and its extent remains to be determined on the basis of macroeconomic data. After the latest central bank meetings, the markets acknowledged that they had indeed gotten carried away. As of the end of January, expectations priced into forward rates suggest about five rate cuts in 2024, beginning in April or, more likely, June.

We still believe that rate-cut forecasts for 2024 are a little too ambitious. Even so, we believe the zones of 2.30% on the Bund and 4% on T-Notes price in the long section of the curve properly.

So it is around a neutral zone that we feel the best opportunities for returns will be on offer via corporate bonds and money-market funds.

YIELD STILL ON OFFER IN CORPORATE BONDS BUT KEEP AN EYE ON IDIOSYNCRATIC RISKS

Against this backdrop, the credit markets continued to post gains. High yield bonds, which are riskier, slightly outperformed investment grade bonds, which are higherrated. The lowest-rated issuers (CCC or B) even outperformed BB, which shows that investors are recovering their risk appetite. But there could always be some very serious idiosyncratic risks, such as in the case of Atos*, some of whose bonds fell by almost 60% on the month. The saga has dragged on for several long months for this French company, an international leader in digital transformation. Some of its bond prices have plunged on difficulties in restructuring its debt and refinancing. This shows how important it is to keep watch over Idiosyncratic risks. Even so, risks of an acceleration of company bankruptcies are likely to be contained, among other things by central bank rate cuts. These cuts will help limit a significant increase in companies’ debt servicing costs in the medium term. We reiterate our positive view of this asset class while stressing the importance of selectivity and diversification.

About the amount of primary issuance of government, supranational, agency and covered bonds on January on European markets.

| BOND INDICES WITH COUPONS REINVESTED | JANUARY 2024 | YTD |

|---|---|---|

| JPM Emu | - 0.48% | - 0.48% |

| Bloomberg Barclays Euro Aggregate Corp | 0.14% | 0.14% |

| Bloomberg Barclays Pan European High Yield in euro | 1.02% | 1.02% |

Past performances are not a reliable indicator of future performances.

EQUITIES

SAME OLD SONG?

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

Performances in 2023 were marked by a large number of uncertainties. And yet, the equity markets cast those doubts aside and focused only on those factors likely to push them a bit higher, i.e., wellanchored expectations of future interest rate trends and the return of earnings growth on both sides of the Atlantic in 2024. And it was the steep pullback in long bond yields at the very end of the year that triggered an equity rally. The rally appears to have spilled over into early 2024.

The US is still on two tracks – the old economy or the new economy. This is apparent in earnings releases, which are still a mixed bag. Manufacturers do not appear yet to have resolved their inventory issues, as seen in the releases of PPG*, 3M* and Dupont* in chemicals, as well as, more surprisingly, in capital goods at Rockwell Automation*.

And it is hard to see a path back to better fortune for some of these sectors, with manufacturing PMIs stuck below 50. Consumer goods are holding up, albeit to various degrees. Nike* issued a profit warning in late December, due mainly to disappointing Chinese sales, while Deckers* (Hoka, Ugg) raised its guidance once again. Retailers are still being forced to adjust to the trading down phenomenon, with customers having become highly pricesensitive.

Specialists in the high end (Costco*) and the low end (Dollar Tree*) are faring well, as their formats are well suited to their customers. It is in the middle that things become more challenging, and there that margins are being squeezed amidst lacklustre volume growth.

WIDE DISPARITIES IN COMPANY PERFORMANCES

The artificial intelligence (AI) ecosystem is still drawing investor interest, despite record performances in 2023. Two chipmakers, Nvidia* and AMD*, are up by almost 25% on the year to date, driven by a wave of upgrades of forecasts of their still robust earnings. Investments in AI over the next two years will be huge and that’s what’s pushing the sector up. Keep in mind, however, that the “Magnificent 7” are now the “Magnificent 6”, since Tesla* ran off the road, driven by an especially disappointing interim release.

Lastly, the commercial real-estate risk reemerged at the end of the month, sending shares in regional banks down by almost 10% on the disastrous release by New York Community Bank. In Europe. Releases by LVMH* and Richemont* have awakened a luxury sector that took a big hit in 2023, and allowed European indices to make up some of the ground they had lost to their US peers. There’s still a market out there for high-end and even ultra-high-end products, including in China, where sales have rebounded despite a still sluggish economy. AI’s impact in Europe showed up in an order book at ASML* that was three times bigger than analysts expected, thus sending the stock up sharply. In contrast, BNP Paribas* and Dassault Systèmes* came in below expectations and their two stocks paid a heavy price.

China is suffering one setback after another, with the Evergrande* bankruptcy and Snowball* products) and its markets continued to plunge into the abyss. Rumours of an upcoming official intervention to stabilise the markets are increasingly insistent and could revive investors’ appetite for China, which they have snubbed for several quarters now.

All in all, barring a boost to the markets from steep rate cuts on both sides of the Atlantic, or from upgrades in earnings forecasts, and assuming, as we do, that they are reasonably priced (especially in Europe), we reiterate our forecast of single-digit gains on equity markets this year.

The gain in Nvidia’s* shares just in January, after +240% in 2023.

| EQUITY INDICES WITH NET DIVIDENDS REINVESTED, IN LOCAL CURRENCIES | JANUARY 2024 | YTD |

|---|---|---|

| CAC 40 | 1.60% | 1.60% |

| EuroStoxx | 1.94% | 1.94% |

| S&P 500 in dollars | 1.65% | 1.65% |

| MSCI AC World in dollars | 0.59% | 0.59% |

* These companies are cited for information purposes only. This is neither an offer to sell nor a solicitation to buy securities.

EMERGING MARKETS

2023 HAS SPILLED OVER INTO 2024… SO FAR

Chief Executive Officer

SYNCICAP ASSET MANAGEMENT

The new year saw no disruption in the performance hierarchy. The swoon in Chinese markets continued, while emerging bonds and Asian ex China equities continued to fare well, as they had in 2023. What about the coming months?

The MSCI China index fell by 10.5% in January (in USD) and is now almost 70% off its 2021 highs. Investors are still in a very dark mood, something that is increasingly difficult for the political authorities to ignore. That being said, valuations, which are very low in both absolute terms and relative to other markets, are beginning to draw interest. The 2024 P/E of the MSCI China index is now below 10, with earnings growth forecast at between +10% and +15% in 2024. Some major US asset managers have recently advised returning to China, and we are starting to see some inflows (see chart).

HOPES FOR A CHINESE EQUITY RALLY?

Historically, Chinese equities have on several occasions shown a very robust capacity for rallying, often by about 30% in a few weeks. Prime Minister Li Qiang has called for “energetic” action to stabilise the markets. On 4 February, the CSRC (the Chinese financial market supervisor) called for a market support plan of as much as 1400 billion dollars, beginning with a fund of 300 to 500 billion dollars. This would come on top of the 280 billion dollars raised from assets held abroad by public-sector companies. President Xi Jinping has also promised some “comforting” measures for the private sector and foreign companies. Details won’t be unveiled until the annual legislative sessions in early March. A significant rally by Chinese shares looks possible in the coming months. Then it will be time to take some profits and analyse China’s structural developments.

BULLISH MOMENTUM STILL IN PLACE ON OTHER ASIAN MARKETS

After gaining almost 20% in 2023, the MSCI EM Asia ex China index consolidated slightly in January, slipping by 0.5% in January (in euros), driven mainly by South Korea (-8%). Last year’s top-performing markets remained so, such as India (+3.5%), where growth remains robust and the recent recovery in PMI indicators are pointing to 6.5% in its estimated trend growth.

Taiwan stabilised (+0.75%), with further support from TSMC*. The semiconductor leader reported forecast-beating results for the fourth quarter of 2023 and raised its 2024 AI guidance. More generally, we like the information technology sector, which accounts for almost 39% of the MSCI EM Asia ex-China index. 2024 P/E on Asian equities ex China as a whole is at almost 15, with earnings growth forecast at about 15%, which should be close to the market performance forecast for 2024.

THE OUTLOOK IS STILL BRIGHT FOR SOVEREIGN EMERGING DEBT IN LOCAL CURRENCIES

The expected stabilisation of US bond yields is likely to drive the trend towards lower interest rates in some emerging markets, particularly in Latin America. For example, Brazilian bonds are yielding an average of 10.1%, and Mexican bonds, 9.2%, even though inflation has already fallen and is now close to 4.6% in both countries. The asset class’s overall yield is currently 6.17%. Meanwhile, emerging currencies have fallen sharply on the whole in recent years and now look undervalued. A stabilisation of the dollar could help them recover. We reiterate our initial forecasts of a performance between 5% and 10% from this asset class in euros for the full year.

This is how much Chinese equities listed in China and Hong Kong have lost in market cap since their 2021 highs – equal to almost twice France’s GDP!

* These companies are cited for information purposes only. This is neither an offer to sell nor a solicitation to buy securities.

Syncicap AM is a portfolio management company owned by Ofi Invest (66%) and Degroof Petercam Asset Management (34%), licensed on 4 October 2021 by the Hong Kong Securities and Futures Commission. Syncicap AM specialises in emerging markets and provides a foothold in Asia, from Hong Kong.

Document completed on 06/02/2024

Carry: a strategy that consists in holding bonds in a portfolio, possibly even till maturity, in order to tap into their yields.

Core inflation: inflation ex energy and ex food.

Inflation: loss of purchasing power of money which results in a general and lasting increase in prices.

Inflation breakeven: rate is the difference between the yield on a traditional bond (nominal yield) and the yield on its inflation-indexed equivalent (real yield).

Investment Grade / High Yield credit: Investment Grade bonds refer to bonds issued by borrowers that have been rated highest by the rating agencies. Their ratings vary from AAA to BBB- under the rating systems applied by Standard & Poor’s and Fitch. Speculative High Yield bonds have lower credit ratings (from BB+ to D, according to Standard & Poor’s and Fitch) than Investment Grade bonds as their issuers are in poorer financial health based on research from the rating agencies. They are therefore regarded as riskier by the rating agencies and, accordingly, offer higher yields.

Manufacturing PMI: index measuring the business activity of Purchasing Managers in the industrial sector.

PER: Price to Earnings Ratio. A stock market analysis indicator: market capitalisation divided by net income.

Spread: difference between interest rates. Credit spread is the difference in interest rate between a corporate bond and a same-dated benchmark bond that is regarded as the least risky (benchmark government bond). Sovereign spread is the difference in interest rate between a sovereign bond and a same-dated benchmark bond that is regarded as the least risky (German benchmark government bond).

Volatility: corresponds to the calculation of the amplitudes of variations in the price of a financial asset. The higher the volatility, the riskier the investment will be considered.

This promotional document contains information and quantified data that Ofi Invest Asset Management considers to be well-founded or accurate on the day on which they were produced. No guarantee is offered regarding the accuracy of information from public sources. The analyses presented are based on the assumptions and expectations of Ofi Invest Asset Management at the time of the writing of this document. It is possible that such assumptions and expectations may not be validated on the markets. They do not constitute a commitment to performance and are subject to change. This promotional document offers no assurance that the products or services presented and managed by Ofi Invest Asset Management will be suited to the investor’s financial standing, risk profile, experience or objectives, and Ofi Invest Asset Management makes no recommendation, advice, or offer to buy the financial products mentioned. Ofi Invest Asset Management may not be held liable for any damage or losses resulting from use of all or part of the items contained in this promotional document. Before investing in a mutual fund, all investors are strongly urged, without basing themselves exclusively on the information provided in this promotional document, to review their personal situation and the advantages and risks incurred, in order to determine the amount that is reasonable to invest. Photos: Shutterstock.com/Ofi Invest. FA24/0045/05082024.