PERSPECTIVES

MARKET AND ALLOCATION

Our experts monthly overview

OUR CENTRAL SCENARIO

Deputy Chief Executive Officer,

Chief Investment Officer

OFI INVEST ASSET MANAGEMENT

Elections were the markets’ focus in June in France, the United States and the United Kingdom but without undermining our baseline scenario at this point.

In the US, the first debate between Donald Trump and Joe Biden cast light on the shakiness of the Democrats and their candidate. The markets are beginning to price in a victory by Donald Trump. While few details have been made public, his platform is regarded as more inflationary, and hence less likely to allow for Fed rate cuts, but offset by a likely resumption of tax cuts begun in 2017. The equity and bond markets have mostly shrugged this off at this stage of the game.

In France, legislative elections produced a fragmented National Assembly, with no meaningful governing majority. The next measures of the future government will probably have to be negotiated one by one before being passed, which would seem to rule out any major shifts in financial direction at a time when the trajectory of public finances is on a shaky footing. This point will be highlighted during the preparation of the budget this autumn and the give-and-take with the European Commission, which has launched excessive deficit procedure against France.

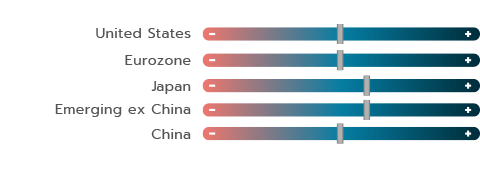

The ratings agencies are likely to take note of this state of affairs and place French debt under and surveillance before probably downgrading it to ‘A’ in the coming quarters. The French/German spread is therefore likely to widen from current levels, as single ‘A’ is currently trading at 70 to 80 basis points.

Nevertheless, against this electoral backdrop, our baseline scenario is unfolding as expected, and the impacts of spreads could be absorbed by shifts in bond yields (the 10-year OAT is at the same level as the day before the dissolution). If the moderation already seen in inflation and employment in the US continues this summer, that should allow the US Federal Reserve to lower its rates once again in September and possibly in December.

The European Central Bank, meanwhile, continues to keep close watch on inflation, but the fragile economic recovery is likely to cause it to stick to its easing cycle, with two rate cuts, as well, between now and yearend.

Against this backdrop, we still prefer the fixed-income asset class for its visibility on yields, particularly, in the context of monetary easing, highly rated or high yield corporate bonds.

US equity markets have mostly shrugged off recent events and continue to trend upwards, driven by the tech sector. Europe, and France in particular, have traded sideways. We reiterate our neutral stance with convexity on this market and are ready to take advantage of coming bouts of volatility to reposition on equities, in particular given the economic outlook expected for 2025.

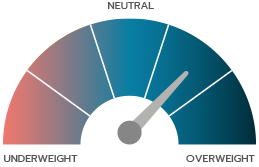

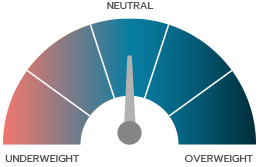

OUR VIEWS AS OF 09/07/2024

Despite the uncertainty generated by political risks, we are leaving our baseline scenario unchanged. After an initial rate cut by the European Central Bank, on 6 June 2024, two more reductions look likely in the euro zone this year. A Fed rate cut is still on the cards for September before possibly another one in December. On the month, the 10-year US yield narrowed from 4.50% to 4.40%, and the Bund from 2.66% to 2.50%. This was driven slightly by uncertainty surrounding elections in France. Against this backdrop, we reiterate our positive view on the fixed-income asset class, while leaving our cursors in place. There are still some carry opportunities in corporate bonds. In government bonds, we continue to overweight duration slightly in portfolios, in particular in the short section of the German yield curve.

No change had been made in our allocations by early July. US equity markets continue to be driven by the same tech stocks, which are now reaching high valuations. Half-year releases will provide more insight into how underlying demand-side factors are faring in the US and, more to the point, on how solid US consumer spending is. Second-half performances will therefore depend closely on the guidance of US companies. In Europe, Emmanuel Macron’s surprise dissolution of the French National Assembly brought back the spectre of a geopolitical risk premium on Europe, just as non-resident investors were once again taking an interest in the euro zone. This new development is very likely to give them pause in their allocation choices.

The euro/dollar exchange rate has been in a tight trading range since the start of the year, lacking any major catalyst. The gap in timing on monetary policy between the Fed and the ECB does not seem wide enough to become the main driver of the exchange rate in our baseline scenario central. The dollar remains overvalued on fundamentals vs. the euro and other main currencies. For it to gain meaningful ground, either the Fed would have to push its easing cycle back beyond 2024, or a hard landing would have to revive its safe haven status. We remain slightly constructive on the yen, based on our view that it will remain undervalued in the medium term and that the Bank of Japan could decide to normalise its monetary policy sometime later.

MACROECONOMIC VIEW

US NORMALISATION, EUROPEAN UNCERTAINTIES

Head of Macroeconomic Research

and Strategy

OFI INVEST ASSET MANAGEMENT

GROWTH IS MOVING BACK TO NORMAL IN THE US

Data suggests that the US slowdown is being driven mainly by the channel of private consumption, now that excess post-Covid savings have been almost entirely used up and pockets of weakness are emerging in least well-off households. That being said, household balance sheets are sound, and the job market is still holding up well, which is reassuring. For the moment, the normalisation of the job market has occurred through the resorption of vacant positions, with no net job destructions. However, signals are sometimes at odds with one another. For example, household surveys are painting a darker picture of the job market than business surveys, and, unusually, job creations are concentrated in non-cyclical sectors, such as education, healthcare and government and are taking the form of temporary contracts. Job market trends will play a more decisive role in the Fed’s reaction function than they did last year.

HOWEVER, IN THE SHORT TERM INFLATION WILL REMAIN DECISIVE FOR MONETARY POLICY

The past two months have confirmed that the reacceleration in services prices early this year was due not to persistent excessive demand, but to temporary idiosyncratic factors, and that real-estate inflation continues to recede gradually.

This provided the Fed with some reassurance and it is still on track for an initial rate cut in September if inflation is not higher than expected in the three releases planned between now and then.

THE FIRST PRESIDENTIAL DEBATE DISRUPTS POLLING DATA

The markets are starting to cast an eye on the possible economic repercussions of the US presidential election following the first televised debate, which pushed Donald Trump further ahead in the polls. Investors consider “Trumpian” policies to be more inflationary, and these fears will materialise in a context in which projected budget deficits are already quite high for the coming years, regardless of the election outcome.

ECB EXPECTED TO HIT THE PAUSE BUTTEN FOR JULY

The dip in European economic surveys for June shows that the recovery that began in the first quarter is still shaky, particularly in Germany, where manufacturing in particular is sluggish. But inflation is expected to recede gradually and consumption to remain solid for the rest of the year, barring a shock to confidence. It will therefore be worth keeping an eye on the impact of political uncertainties on the confidence of economic actors in the coming months, especially in France.

Inflation fell by 10bp, to 2.5% yearon- year (as expected) in June, but core inflation remained stuck at 2.9% YoY. Services inflation was unchanged, at 4.1%, which is consistent with the ECB’s hitting the pause button at its July meeting, but which probably does not close the door to two more rate cuts between now and yearend.

FRANCE AND ITS BUDGET SITUATION UNDER SURVEILLANCE

France’s fiscal standing is still poor, and the ratings agencies are keeping a close eye on it. Moody’s is now more likely to downgrade France this year. In doing so, it would catch up with the ratings of Fitch and Standard & Poor’s. Lower the public deficit to 3% of GDP by 2027 isn’t a credible target, nor is managing to comply with the adjustments (0.5 percentage point of GDP per year) requested by the European Commission, which has proposed placing France in an excessive debt procedure. There is no governing majority for such a fiscal consolidation, something that could accelerate Fitch’s switching its rating to a negative outlook. If so, France would be just one notch from being downgraded to average quality (“A”). This would justify keeping the country risk premium (as measured by the OAT-Bund spread) 50-55 basis points higher than the average of the past two years.

INTEREST RATES

HOW ARE THE BOND MARKETS FARING IN MID-YEAR?

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

Markets have been driven in recent weeks by political events: European elections and the dissolution of the French National Assembly, followed by legislative elections, the election of a Labour government in the UK, and the US presidential debate. These events and their repercussions will matter in estimating the fair value of financial assets in the coming months. That being said, while political trends may guide fiscal policies or investor confidence, macroeconomic data remain the markets’ main anchor point. These data were especially robust in the first half of the year, justifying keeping monetary policies in restrictive territory. Stable interest rates tend to reassure investors. With rates still high and one or two cuts by the Fed and ECB priced in by the markets in 2024, central banks still have relatively wide manoeuvring room, in the event that there is a greater need for action.

HOW ARE FIXED-INCOME ASSETS FARING?

Euro zone bond performances were neutral or slightly positive in June, as they had been during the rest of the first half of the year.

At mid-year, high yield is leading the way, with the Bloomberg Barclays Pan European High Yield in euros gaining 3.23%. It outperformed the money market, which gained more than 2.00% by riding a ECB deposit rate, which was still high, at 3.75% at the end of June. Investment grade came in third, with a gain of 0.54% on the first half. This was lower than in 2023, due mainly to trends in long bond yields, with euro zone government bonds ending the half in negative territory, at -1.89%. By way of explanation, take note that the benchmark 10-year Bund yield had pulled back in late 2023, before moving from 2.0% at the start of the year to 2.5% at the end of June. Meanwhile, credit spreads fared well, supported by generally solid corporate earnings. Naturally, this benefited corporate bonds and high yield bonds in particular, which we have now been recommending for several months.

FRANCE-GERMANY

Standard & Poor’s’ downgrade of France from AA to AA- did not cause a widening in spreads between France and Germany, unlike the announcement of the dissolution of the French National Assembly by Emmanuel Macron on the evening of the European elections. The 10-year spread set a record since 2012, at 81 basis points at the end of June, before receding the day after the first round of legislative elections. Bank debt also came in for special punishment. No clear majority emerged from the second round of elections, which will make France hard to govern in the coming months. This outcome is bad news for France’s public finances, but should be kept in perspective, given the various scenarios that were circulating prior to the second round. tour. And, lastly, keep in mind that the French state’s financing programme is well along for 2024 and is unlikely to be at risk in the near term. More attention is likely to be devoted to the 2025 budget, with announcements scheduled for 15 October. Against this backdrop, our preference in terms of duration is clearly the short section of the yield curves, particularly on Germany. We expect yields to move within a trading range over the next few months, with France’s spreads structurally higher than prior to the elections.

This is the widest spread, in basis points, between 10-year French and German government bonds in June.Unprecedented since 2012. The spread narrowed back to 65 after the second round of legislative elections in France.

| BOND INDICES WITH COUPONS REINVESTED | JUNE 2024 | YTD |

|---|---|---|

| JPM Emu | 0.19% | -1.89% |

| Bloomberg Barclays Euro Aggregate Corp | 0.66% | 0.54% |

| Bloomberg Barclays Pan European High Yield in euro | 0.44% | 3.23% |

EQUITIES

TWO TRADING FLOORS, TWO ATMOSPHERES

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

Global markets were highly dispersed in June.

Across the Atlantic, US equity markets continued to rise, with indices closing one of their best half-year periods ever. Europe, meanwhile, traded sideways. The dissolution of the French National Assembly by Emmanuel Macron resulted in a spike in both the geopolitical risk premium and bond yields in the euro zone. The EuroStoxx ended the month lower and, unsurprisingly, our CAC 40 ended the month in last place, down by 6%.

ALL-TIME RECORDS IN THE US

US markets set record after record. The S&P 500’s aggregate market cap is up by 6,000 billion dollars on the year to date, its biggest gain ever.

Artificial intelligence (AI) fever continues, and tech stocks continue to drive index gains. Since we’re on the subject of records, only 24% of index stocks have outperformed the index on the year to date, one of the lowest participation rates ever. So traditional sectors continue to lag behind, due to slowing economic activity, as seen in recent ISM leading indicators. Companies’ business activity is being held back by slackening demand, due, in turn, to consumption that is weakening, as households fear a worsening in their future prospects.

LAUNCH OF THE US PRESIDENTIAL CAMPAIGN

The month’s major event was undeniably the first televised debate between the two US presidential candidates.

There is general agreement that Joe Biden’s performance was not up to par. Online betting sites are now giving the Democratic candidate just a 20% chance of winning the election. Donald Trump looks well placed to win in November. And the markets are betting that his policies will be more inflationary. Bond yields even rose during the debate itself.

Meanwhile, some “pro-Trump” sectors have already begun to rally. For example, the oil sector has just shown some life, pricing in a policy more favourable to traditional energies. The same goes for the banking sector, which could benefit from a drastic reduction in regulation in the event of a Republican victory.

EUROPE SHAKEN

Europe’s outperformance vs. the S&P 500 did not last long. All it took was the dissolution of the French National Assembly by Emmanuel Macron to reshuffle the cards and cause non-resident investors to lose interest once again, even as indicators are pointing to an improvement in the economy. On top of the political backdrop, the French market was also penalised by two idiosyncratic events. First, Eurofins* had to fight off the attacks of a shortseller after a report published by an analyst at Muddy Waters*. Although Eurofins denied the accusations, its share price still dropped by almost 16%. And, second, Airbus* lowered its 2024 earnings guidance, due to ongoing pressures on its supply chain and to a new provision in its satellite division. The stock ended the month down by 18%.

The gain in market capitalisation by the S&P 500 on the year to date. An all-time record!

| EQUITY INDICES WITH NET DIVIDENDS REINVESTED, IN LOCAL CURRENCIES | JUIN 2024 | YTD |

|---|---|---|

| CAC 40 | -6.25% | 1.22% |

| EuroStoxx | -2.72% | 7.94% |

| S&P 500 in dollars | 3.55% | 15.05% |

| MSCI AC World in dollars | 2.23% | 11.30% |

EMERGING MARKETS

THREE QUESTIONS AFTER A RATHER PROMISING FIRST HALF

Chief Executive Officer

SYNCICAP ASSET MANAGEMENT

After three years of decline, Chinese equities gained almost 5%. Is this a dead-cat bounce or a more sustained rally? Asian ex-China equities took off, driven by a combination of three drivers of growth. Can this last? Emerging market bonds in local currencies held up well to a firm dollar and a challenging electoral context in several countries. Is the worst behind us?

CHINESE EQUITIES

After two disastrous weeks to start the year and a 10% drop, Chinese equities gained more than 30% between mid- January and mid-May, before pulling back somewhat. This rally was driven by several factors: 1/ the government’s announcement of a series of measures to resolve the real-estate crisis; 2/ economic statistics showing that the government’s 5% growth target looks credible; and 3/ Chinese equity valuations that were rather low, which drew some inflows from international investors.

More catalysts will be required, which could come from a new political impetus. It will be worth keeping a close eye on the “Third Plenum” meeting, which traditionally focuses on broad economic goals. It goes back to a 1978 meeting, when Deng Xiaoping made some radical changes to open up the Chinese economy and free up the private sector. This year’s Third Plenum will unfold against the backdrop of a prolonged real-estate crisis and the general weakness of household confidence. President Xi Jinping raised investors’ hopes in stating that China was planning “major measures to deepen the reforms”, particularly on the way that it will go about generating “high-quality” growth and “modernising” the country.

Chinese equities remain rather attractive on the whole in terms of absolute valuation and relative to other markets, with a P/E of almost 11 and projected earnings growth of about 15% in 2024 and 13% in 2025. Keep an eye on the July releases to find out whether this “value play” turns into a “value trap”, as we have seen all too often over the past three years.

EX-CHINA EMERGING ASIAN EQUITIES

In contrast, ex-China emerging Asian equities are up by almost 20% on the year to date, since we launched this new strategy, on 10 January. Its main markets are India, Korea and Taiwan.

However, on top of these geographical considerations, this strategy is an opportunity to invest in three longterm growth themes and that are at the start of their cycles: the development of artificial intelligence, with lots of Asian companies integrated into the global AI value chain; expanded consumption by an emerging middle class in heavily populated countries like India and Indonesia; and strategies for working around China’s industrial supply chains, which benefit other Asian economies. While US AI stocks are pulling back after robust gains in recent months (there is an obvious correlation between major Asian suppliers and the US leaders in the value chain), other themes are decorrelated. So there could be a little volatility in the short term, but the medium- and long-term outlook looks very promising.

EMERGING MARKET BONDS

Volatility was very low in local-currency European bonds during the first half of the year, despite many political uncertainties and a somewhat firm dollar, which traditionally weighs on emerging market currencies. The second half of the year looks less agitated politically and more “readable” regarding US monetary policy. The asset class’s intrinsic yield, at 6.6% currently, as well as a relative undervaluation of local currencies on the whole, should open the door to a positive performance in the coming months.

Consensus forecast of 2024 earnings growth of companies listed in China.

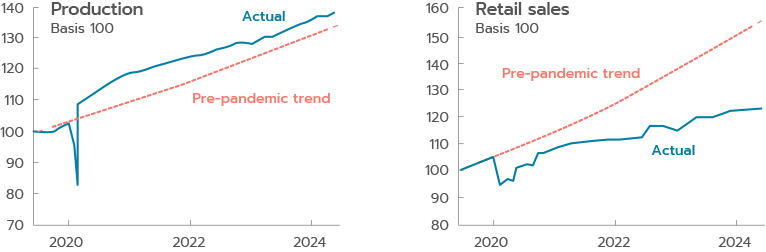

Consumption has not returned to its pre-Covid level, unlike manufacturing output.

Document completed on 09/07/2024

Carry: a strategy that consists in holding bonds in a portfolio, possibly even till maturity, in order to tap into their yields.

Duration: weighted average life of a bond or bond portfolio expressed in years.

Inflation: loss of purchasing power of money which results in a general and lasting increase in prices.

Inflation breakeven rate: the difference between the yield on a traditional bond (nominal yield) and the yield on its inflation-indexed equivalent (real yield).

Investment Grade / High Yield credit: Investment Grade bonds refer to bonds issued by borrowers that have been rated highest by the rating agencies. Their ratings vary from AAA to BBB- under the rating systems applied by Standard & Poor’s and Fitch. Speculative High Yield bonds have lower credit ratings (from BB+ to D, according to Standard & Poor’s and Fitch) than Investment Grade bonds as their issuers are in poorer financial health based on research from the rating agencies. They are therefore regarded as riskier by the rating agencies and, accordingly, offer higher yields.

ISM manufacturing index: the ISM manufacturing index of economic activity is based on a survey of purchasing managers in the industrial sector.

PER: Price to Earnings Ratio. A stock market analysis indicator: market capitalisation divided by net income.

Quantitative Easing: massive purchases of debt securities by a central bank.

Risk premium: reflects the additional return demanded by investors compared to a risk-free asset.

Spread: difference between rates.

Volatility: corresponds to the calculation of the amplitudes of variations in the price of a financial asset. The higher the volatility, the riskier the investment will be considered.

This promotional document contains information and quantified data that Ofi Invest Asset Management considers to be well-founded or accurate on the day on which they were produced. No guarantee is offered regarding the accuracy of information from public sources. The analyses presented are based on the assumptions and expectations of Ofi Invest Asset Management at the time of the writing of this document. It is possible that such assumptions and expectations may not be validated on the markets. They do not constitute a commitment to performance and are subject to change. This promotional document offers no assurance that the products or services presented and managed by Ofi Invest Asset Management will be suited to the investor’s financial standing, risk profile, experience or objectives, and Ofi Invest Asset Management makes no recommendation, advice, or offer to buy the financial products mentioned. Ofi Invest Asset Management may not be held liable for any damage or losses resulting from use of all or part of the items contained in this promotional document. Before investing in a mutual fund, all investors are strongly urged, without basing themselves exclusively on the information provided in this promotional document, to review their personal situation and the advantages and risks incurred, in order to determine the amount that is reasonable to invest. Photos: Shutterstock.com/Ofi Invest. FA24/0202/08012026