PERSPECTIVES

MARKET AND ALLOCATION

Our experts monthly overview

OUR CENTRAL SCENARIO

Deputy Chief Executive Officer,

Chief Investment Officer

OFI INVEST

As expected, the European Central Bank (ECB) lowered its key rates by one quarter of a percentage point, on 6 June. The ECB was no doubt forced to take action more by its repeated announcements in recent months than by the latest economic releases. Like the US Federal Reserve, the ECB has now taken a data-dependent stance. We nonetheless expect the ECB to make two additional cuts (one each quarter) between now and yearend, tracking inflation’s gradual return to its target.

In the United States, employment and economic activity figures are blowing hot and cold, respectively, at the Fed for the adjustment of its short-term rates. The coming inflation figures are likely to be in the right direction for the Fed to make an initial rate cut in September, followed, no doubt, by a second one late this year. That is still our baseline scenario.

European elections confirmed the rise of far-right parties, albeit to a little lesser degree than expected.

The real surprise came from France, with the decision from the Élysée Palace to dissolve the National Assembly. This opens up an era of uncertainty, given the tight calendar and the way that battlelines are being drawn.

We reiterate our general recommendation on long-term bonds: take advantage of soaring yields to add to exposure and, conversely, take some profits when they pull back too fast, as the 10-year US yield did recently. More in detail, in France, the coming period will probably bring with it volatility that is asymmetric with the expansion in French debt. While the examples of Liz Truss and Georgia Meloni will surely be on the minds of the next government, we are awaiting greater visibility, before and after the elections, before taking a position on the OAT (Obligation Assimilable du Trésor), as well as a significant risk premium.

We continue to overweight corporate bonds in our bond allocation, given their risk/return pairing, which we still believe is favourable.

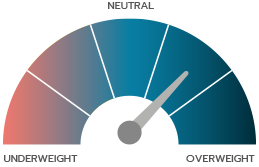

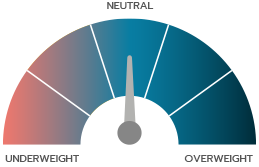

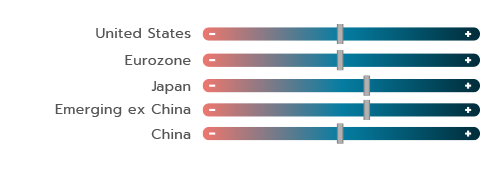

On the equity markets, we reiterate our neutral stance, with convexity or protection positions to exploit the recent volatility expected around central bank trajectories. With European markets trading at a discount and with the coming monetary easing, we prefer them for possible repositioning on the markets. However, we are still waiting on the sidelines, pending greater visibility on the fallout from European elections and, above all, the dissolution of the National Assembly.

OUR VIEWS AS OF 10/06/2024

After an initial rate cut by the European Central Bank (ECB) on 6 June 2024, the pace of any further cuts will depend on inflation data and, in any case, should be gradual. Following the recent meeting, only one more cut is being completely priced in for the ECB and the Fed in 2024. Long US bond yields receded on the month, and spreads narrowed vs. European yields, which rose slightly. While monetary policies seem to be converging more than in recent months, this is also due to growth momentum, which is tending to improve more in Europe than in the United States. Against this backdrop, we reiterate our positive view of the bond asset class, with an upgrade to our overall score. We are raising our conviction on the money market, which is likely to benefit from the smaller rate cuts now being priced in for this year, and we are moving high yield to the same level as investment grade for its carry and its fundamentals.

Few changes in our equity views as a whole. Clearly, relative valuation is in Europe’s favour, especially as the ECB has fired the first shot on rate cuts. That said, Europe is suffering from its low exposure to artificial intelligence, which has caused US megacaps to drive indices in the US. For as long as enthusiasm for this thematic has not receded, the US markets will remain overvalued. We are sticking to our bias in favour of the Japanese market, which is riding the depreciation of the yen and a reasonable valuation. In conclusion, the best strategy in our view is to maintain positions on the asset class but while introducing portfolio-protection options strategies in the event of heightened volatility.

There is too little difference in monetary policy between the Fed and the ECB to generate a pronounced upward or downward shift in the euro-dollar exchange rate. For the dollar to appreciate significantly, either the Fed will have to postpone its monetary easing to after 2024, or a hard landing will have to revive the dollar’s safe haven status. We remain slightly constructive on the yen, assuming that it will remain undervalued for the medium term and that the Bank of Japan could decide to normalise its monetary policy later.

MACROECONOMIC VIEW

INFLATION IN SERVICES IS A KEY CONCERN

Head of Macroeconomic Research

and Strategy

OFI INVEST ASSET MANAGEMENT

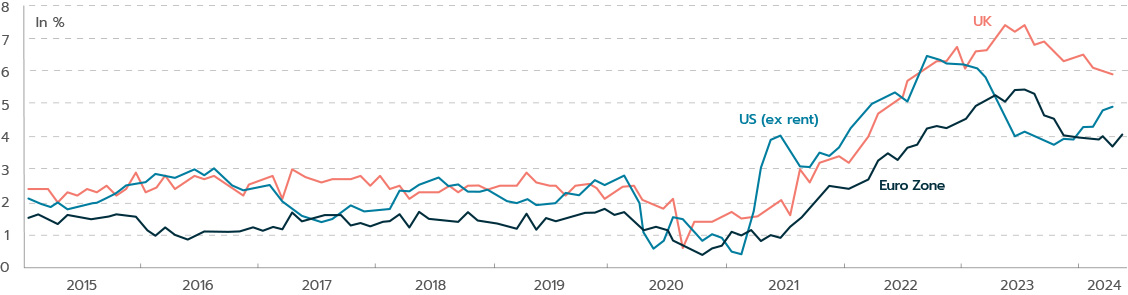

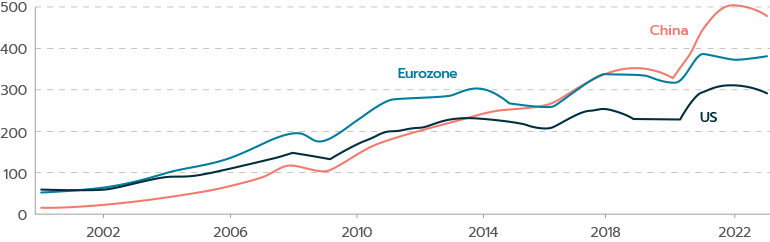

Lower energy prices, the receding of food inflation, and disinflation in goods have so far played a leading role in normalising of inflation. Downward potential of its components now appears to have run its course, and the last mile of disinflation must be driven solely by inflation in services, which is its most rigid component. This is the common denominator between the US and Europe (see chart) and it’s what is extending the homestretch towards the 2% inflation target.

A SMALL STEP IN THE RIGHT DIRECTION IN THE US…

US inflation pulled back to 3.4% year-on-year in April, and the personal consumption expenditures deflator, which is the US Federal Reserve’s inflation benchmark, had already fallen below 3% since last October and is now at 2.7%. May data were reassuring, and the short-term inflation momentum in services receded, in particular transport services (insurance and auto repairs), which caused the early-year reacceleration. This seems to confirm that the recent surge is not demand-driven and that this inflation is likely to normalise in the coming quarters.

Moreover, the moderation in consumption seen in the first quarter and in April seems to show that normalisation already under way. Signs of weakness are already emerging among low-income individuals, with data showing that late payments are increasingly frequent by the most heavily indebted borrowers.

However, high- and medium-income American individuals are still in sound financial standing. A potential calming in consumption should also help keep disinflation going.

…BUT THE FED STILL FACES A NARROW PATH AHEAD

On the whole, the latest data come as a relief to the Fed but are only a small step in the right direction. The Fed still faces al narrow path, and there must be no further surprises on the inflation front if rate cuts are to materialise, unless the labour market ends up far weaker than expected. The Fed could then lower its rates for the first time, probably in September.

FOOD FOR THOUGHT FOR HAWKS IN EUROPE…

In Europe, inflation in services remains stubbornly high in the United Kingdom, reaching 5.9% in April, and is postponing the Bank of England’s monetary easing cycle. In the euro zone, total inflation rose from 2.4% to 2.6% year-onyear in May, but inflation in services bounced back from 3.7% to 4.1%. Inflation is unlikely to recede until yearend, due to the intrinsic rigidity of services prices. Meanwhile, wage momentum, a variable highlighted by the ECB, stayed high in the first quarter (4.7% year-on-year, vs. 4.5% in the fourth quarter 2023). Based on the ECB’s wage projection index, replies from companies to the ECB’s phone survey, and wage data from new job offers, we can expect wage growth to top off at about 4% this year and not to normalise until 2025.

…JUSTIFY A CAUTIOUS LINE FROM THE ECB

As expected, the ECB lowered its key rates by 25 basis points, but naturally avoided any prior commitment and its future decisions will be closely data-dependent. Even so, gradual rate cuts, possibly one per quarter, are not being ruled out, as the ECB’s new economic projections confirm a return of inflation to 2% in the second half of 2025.

EUROPE HAS VOTED

According to provisional results, the European Parliament elections saw the rise of far right parties continentwide. The consequences of this are already being felt in France, with snap elections being called. However, the main pro-European parties still have an absolute majority of seats and could still form a “grand coalition”. The first plenary session of the new Parliament to elect its president is scheduled from 16 to 19 July, and another plenary session is set for 16 to 19 September to elect the president of the European Commission. So not until just before the US presidential elections will all European institutions be operational.

INTEREST RATES

ONE RATE CUT AND THEN WHAT?

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

To analyse movements on the bond markets in recent weeks, first take a look at trends in macroeconomic data and the central banks’ reaction function. Inflation data in the euro zone has risen steadily, from 2.4% in April to 2.6% in May. This increase did not keep the European Central Bank from cutting its key rate at its 6 June meeting, with a deposit rate lowered by 25 basis points to 3.75%. Indeed, the language of the ECB president, Christine Lagarde, had left little doubt on this rate cut. While the disinflation trajectory has not been questioned, it is the pace of convergence towards the 2% target that appears to have slowed. So, there is no reason to risk cutting rates too soon in Europe for the moment, especially as wage growth is still high. Another important factor is that in the US, the first rate cut does not look imminent.

US macroeconomic data are still quite resilient, in particular in inflation, which for April remained far above the US Federal Reserve’s 3.4% target. The question will now be future rate cuts…or not.

CENTRAL BANKS FOCUSED ON INFLATION

With these data available, we still believe that one or two Fed cuts are likely by yearend and potentially one more in the euro zone.

We believe that the markets’ anticipations of a single rate cut went a little too far, at least in the short term. During May, the German 10-year yield oscillated between 2.42% and 2.68%, with no real steepening in the yield curve. Absolute yields still look attractive but with central banks being data-dependent, the direction of 10-yields is less clear and offers fewer tactical opportunities. Against this backdrop, yields could react to adjustments of anticipations in monetary policy but also to geo(political) issues or technical factors driven by flows and could generate a little more volatility this summer. We are therefore sticking to a slightly positive view on duration, with a preference for the short section of the yield curve, which we believe could benefit from new anticipations of rate cuts.

We also believe that it is worth holding onto some leeway to add to duration positions in the event of further upward surprises on the inflation and growth fronts.

STILL SOME ATTRACTION IN CORPORATE BONDS

As it did early this year, high yield outperformed government bonds and higher-quality investment grade bonds. The credit market on the whole was once again quite busy, with heavy primary issuance and continued heavy inflows into this asset class. Against this backdrop, credit spreads narrowed further. To cite one example, the iTraxx Xover, an indicator of the credit market’s health, hit 286 basis points, a narrow level that reflects the market’s confidence in this asset class. However, narrow spreads do not, in our view, undermine the attractiveness of corporate bonds. For, fundamentals remain sound, as seen in the revision by Standard & Poor’s of the default rate. For the coming 12 months, it was revised to 3.75%, vs. an already low rate of 4.1% in April. So, companies are showing solid credit profiles with shored up balance sheets in most cases, even in the case of high-yield issuers.

The new ECB deposit rate and also the 12-month forward default rate projected by Standard & Poor’s in Europe (baseline scenario).

| BOND INDICES WITH COUPONS REINVESTED | MAY 2024 | YTD |

|---|---|---|

| JPM Emu | - 0,10% | - 2,08 % |

| Bloomberg Barclays Euro Aggregate Corp | 0,27% | - 0,12% |

| Bloomberg Barclays Pan European High Yield in euro | 1,01% | 2,77% |

EQUITIES

RECORDS SET BY ARTIFICIAL INTELLIGENCE

Co-CIO, Mutual Funds

OFI INVEST ASSET MANAGEMENT

May featured new all-time records for most Western equity indices (S&P 500, Stoxx 600, CAC 40, DAX, FTSE, etc.), driven by solid first-quarter releases and, above all, by US macroeconomic statistics (growth and inflation) confirming that recession has been avoided and assuming rate cuts by yearend. The rally on US markets last month is less misleading than what the S&P 500 had gotten us used to since the year began. True, tech stocks are still partying along, but performances became more dispersed during the month and even pushed up smaller caps.

BEYOND AI, SOME QUESTIONS

The star of the month was clearly Nvidia*. The US tech company’s quarterly net earnings soared by 700% year-on-year, surprising even the most bullish financial analysts.

Solid order books and the confirmation of the excellent start of the new Blackwell chip suggest that growth momentum remains solidly anchored. True, hyperscalers(1) like Amazon* and Meta* had already hinted that their capital expenditure would continue to focus on artificial intelligence this year again.

And yet, actors outside the sphere of artificial intelligence (AI) still appear to be very much in wait-and-see mode. The release by the software publisher Salesforce* late in the month served as a stark reminder to investors that companies’ capex will remain stuck, pending a more equivocal sign from the US Federal Reserve of a rate cut. Some companies have an almost identical reading of consumer spending. For example, the DIY retailer Home Depot* hinted that, while US consumers are still extremely resilient, they still seem to be awaiting more favourable financial conditions before making large buying decision. After all, why finance large purchases today when everyone seems to agree that it will soon be less expensive to do so?

GREATER CONFIDENCE IN EUROPE

Surprisingly, the economy looks easier to interpret in Europe. The rise in leading indicators is pointing to a recovery of economic activity in a number of European geographies. Manufacturing appears to be making up lost ground, thus lending credence to the assumption of a steep decline in negative impacts from higher energy prices.

Inflation is likely to continue receding, thus clearing the way for an initial rate cut in the euro zone. We believe that Europe’s markets remain reasonably priced; its companies are well managed; debt levels are under control; and, for once, a far greater consensus among strategists appears to be emerging in favour of investing in European equities. It almost looks as if all conditions are in place for European stocks to begin catching up. In Asia, reform of Japanese corporate governance has begun at last. True, this will take time, but it carries the promise of a likely medium-term rerating of the Japanese market. The main issue is in optimising how Japanese firms allocate capital, torn between abundant cash on their balance sheets and the legacy of heavy cross shareholdings. Balance sheets are beginning to be streamlined and should naturally lead to an improvement in profitability aggregates and shareholder returns. If Japan successfully carries out its transition, the market rerating is no doubt just beginning.

Ultimately, although the possibility of steep volatility cannot be ruled out, owing to the numerous stubborn uncertainties, both in the future direction of central banks’ policies and in political and geopolitical factors, we are sticking to our neutral stance. That being said, we recommend introducing some convexity into portfolios (via options strategies or convertible bonds).

The increase in Nvidia’s* quarterly earnings between the first quarters of 2023 and 2024…

| EQUITY INDICES WITH NET DIVIDENDS REINVESTED, IN LOCAL CURRENCIES | MAY 2024 | YTD |

|---|---|---|

| CAC 40 | 1,20% | 7,97% |

| EuroStoxx | 2,73% | 10,95% |

| S&P 500 in dollars | 4,91% | 11,10% |

| MSCI AC World in dollars | 4,06% | 8,88% |

EMERGING MARKETS

« MAKE CHINA GREAT AGAIN »

Chief Executive Officer

SYNCICAP ASSET MANAGEMENT

The MSCI China is up by more than 20% from its January lows, driven by government measures to restore momentum, with the priorities now being to resolve the real-estate crisis and to get growth back on track. What is the best strategy after the rally?

The extent of the Chinese equity rally is no surprise. After falling by almost 70% between mid-2021 and January 2024, Chinese shares had become steeply undervalued and overlooked. Investors’ most “consensual” positions in early 2024 were “long Magnificent 7”(2), “long dollar” and “short Chinese equities”! As we know, in such a configuration, the markets are vulnerable to the slightest contrarian news…

THE GOVERNMENT GIVES THE MARKET SOME IMPETUS

As is often the case with China, the news came from the government. In recent weeks, President Xi Jinping has shown a real determination to grab hold of economic issues. While recent, first-quarter growth figures are rather satisfactory, especially in manufacturing and exports, falling real-estate prices are weighing on consumer confidence, as is the high unemployment rate among young graduates. This is blocking the path towards making the Chinese economy more reliant on its domestic market, which is necessary in the current, very tense international context. The government’s plan includes several aspects that have already been mentioned, ranging from a form of support for the Chinese equity markets (dividends, share buybacks advocated for state-owned companies, financial market reform, etc.), cancelling of almost all restrictions on real-estate purchases, monetary and fiscal support, etc.

A PLAN TO SUPPORT REAL-ESTATE

The latest measures announced target the real-estate crisis directly. The mechanism being planned is to allow state-owned companies (via loans granted by local governments under the national government’s wing) to buy existing appartements in order to transform them into public housing and rent them out. Apart from a few practical obstacles (quite often some renovation is necessary to adapt the apartments), this sort of real-estate “quantitative easing” would aim to begin purging the backlog of unsold properties, which would ultimately help stabilise prices and once again encourage households to buy.

This plan is controversial. Most observers point out that the amounts committed are too low, given the scale of the backlog, which in value terms is estimated at 2% to 3% of Chinese GDP, or from RMB 2,600 to 3,900 billion (it’s hard to find precise figures on this subject). Buth others, albeit fewer in number, point out that this is a major turning point, in that demand, which is potentially still very high, given the proportion of the population still poorly housed, could take off again, just as construction starts have dried up, thus creating the conditions for a new shortage. The last time that the government took on a housing glut in this way, in 2015 (buying up shantytowns to take them off the market and to transform them thereafter), prices rose.

It will be worth keeping a close eye on the plenary meeting of the Chinese Communist Party in July, as new measures or priorities could be announced.

On the corporate side, earnings forecasts have barely budged in recent weeks, despite the priority being given to the economy. Aggregate earnings growth of the MSCI China is currently at +15% for 2024 and +13% for 2025, which results in a rather reasonable aggregate 2024 P/E of 11.5.

To sum up, Chinese equities are in an intermediate consolidation phase, and the rally that began in January could continue. We believe that economic challenges will be one of the priorities of the policy mix of President Xi Jinping this year. In other words, to borrow a famous US election campaign saying: “It’s the economy, stupid!”

The share of Chinese exports that are invoiced in RMB, vs. 0% in 2021! Chinese companies have accelerated their links with other emerging market countries in recent years for protection against the china +1 movement and risks of a trade war with the us and europe.

Document completed on 10/06/2024

Carry: a strategy that consists in holding bonds in a portfolio, possibly even till maturity, in order to tap into their yields.

Duration: weighted average life of a bond or bond portfolio expressed in years.

Inflation: loss of purchasing power of money which results in a general and lasting increase in prices.

Inflation breakeven rate: the difference between the yield on a traditional bond (nominal yield) and the yield on its inflation-indexed equivalent (real yield).

Investment Grade/ High Yield credit: Investment Grade bonds refer to bonds issued by borrowers that have been rated highest by the rating agencies. Their ratings vary from AAA to BBB- under the rating systems applied by Standard & Poor’s and Fitch. Speculative High Yield bonds have lower credit ratings (from BB+ to D, according to Standard & Poor’s and Fitch) than Investment Grade bonds as their issuers are in poorer financial health based on research from the rating agencies. They are therefore regarded as riskier by the rating agencies and, accordingly, offer higher yields.

PER: Price to Earnings Ratio. A stock market analysis indicator: market capitalisation divided by net income.

Quantitative Easing: massive purchases of debt securities by a central bank.

Risk premium: reflects the additional return demanded by investors compared to a risk-free asset.

Volatility: corresponds to the calculation of the amplitudes of variations in the price of a financial asset. The higher the volatility, the riskier the investment will be considered.

This promotional document contains information and quantified data that Ofi Invest Asset Management considers to be well-founded or accurate on the day on which they were produced. No guarantee is offered regarding the accuracy of information from public sources. The analyses presented are based on the assumptions and expectations of Ofi Invest Asset Management at the time of the writing of this document. It is possible that such assumptions and expectations may not be validated on the markets. They do not constitute a commitment to performance and are subject to change. This promotional document offers no assurance that the products or services presented and managed by Ofi Invest Asset Management will be suited to the investor’s financial standing, risk profile, experience or objectives, and Ofi Invest Asset Management makes no recommendation, advice, or offer to buy the financial products mentioned. Ofi Invest Asset Management may not be held liable for any damage or losses resulting from use of all or part of the items contained in this promotional document. Before investing in a mutual fund, all investors are strongly urged, without basing themselves exclusively on the information provided in this promotional document, to review their personal situation and the advantages and risks incurred, in order to determine the amount that is reasonable to invest. Photos: Shutterstock.com/Ofi Invest. FA24/0159/10122025.